Get the free 405 form

Show details

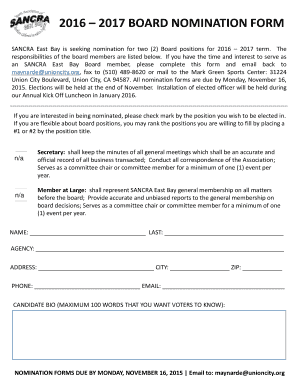

FORM 405 See sub rule 2 of rule 52 TRANSIT PASS UNDER SECTION 69 1 OF THE GUJARAT VALUE ADDED TAX ACT 2003. Serial No* Vehicle / Truck No*carrying the consignment mentioned in the Annexure annexed hereto is permitted to cross the Gujarat State and enter into name of other State. Boarder at Check Post/ Barrier or before date via National Highway/State Highway/District Road mention details of route Place Date Time A. M. / P. M. Signature of the Officer In-charge of Entry Check-Post/Barrier Full...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 405 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 405 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 405 form online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit el 405 certificate of nomination form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

How to fill out 405 form

How to fill out 405 form:

01

Obtain a copy of the 405 form from the appropriate source, such as the official website of the organization requiring the form.

02

Carefully read and understand the instructions provided with the form to ensure accurate completion.

03

Start by entering your personal information, such as your name, address, and contact details, in the designated fields.

04

Provide any additional information requested, such as your social security number or tax identification number, if applicable.

05

Fill out the form according to the specific requirements outlined. This may include providing details about your income, assets, liabilities, or any other information related to the purpose of the form.

06

Double-check all the information entered to avoid any errors or omissions that may delay the processing of your form.

07

Sign and date the form as required, certifying the accuracy and completeness of the information provided.

08

Keep a copy of the completed form for your records before submitting it to the designated recipient or authority.

Who needs 405 form:

01

Individuals or entities who are required to report certain information based on the specific purpose of the 405 form.

02

This form may be necessary for tax reporting, financial disclosure, legal compliance, or any other regulatory requirement.

03

The exact criteria for needing the 405 form may vary depending on the specific organization or governing body requesting it. It is important to refer to the instructions or consult with the relevant authority to determine if you are required to submit this form.

Video instructions and help with filling out and completing 405 form

Instructions and Help about rapid typing download form

Fill 69 gujarat : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 405 form?

A 405 form is a federal form used by employers to report the wages and other compensation paid to their employees. It is used to help the Internal Revenue Service (IRS) determine the amount of taxes owed by an individual. It is also used to report information to the Social Security Administration (SSA) so that an individual's Social Security benefits can be calculated.

Who is required to file 405 form?

The 405 form is typically required to be filed by employers in the state of Illinois who are subject to the Illinois Unemployment Insurance Act.

How to fill out 405 form?

1. Begin by filling in the top portion of the form with your name and contact information.

2. In the "Employer's Name" section, enter the name of your employer.

3. In the "Employee's Name" section, enter your name.

4. In the "Employee's Social Security Number" section, enter your Social Security Number.

5. In the "Employee's Address" section, enter your address.

6. In the "Employer's State Withholding ID Number" section, enter the employer's State Withholding ID Number.

7. In the "Employer's Federal EIN Number" section, enter the employer's Federal Employer Identification Number (EIN).

8. In the "Period Covered" section, enter the dates of the period covered by the form.

9. In the "Employer's Address" section, enter the employer's address.

10. In the "Employee's Wages" section, enter the total wages earned by the employee during the period covered by the form.

11. In the "Employee's Federal Tax Withheld" section, enter the total amount of federal income taxes withheld from the employee's wages.

12. In the "Employer's State Tax Withheld" section, enter the total amount of state taxes withheld from the employee's wages.

13. In the "Employee's Signature" section, sign and date the form.

14. In the "Employer's Signature" section, have the employer sign and date the form.

What information must be reported on 405 form?

The 405 form is used by employers to report unemployment insurance (UI) wages and taxes to the state. The information required on the form includes the employer’s name and address, the employer’s UI account number, the period of wages reported, the total amount of wages paid during the quarter, the amount of taxable wages, the total amount of UI taxes owed, and the total amount of UI taxes paid.

What is the penalty for the late filing of 405 form?

The penalty for the late filing of Form 405 is a fine of up to $100 per day, up to a maximum of $25,000.

What is the purpose of 405 form?

The purpose of Form 405, also known as the "Lending Agreement Certification," is to certify that certain conditions have been met for the project being financed with Federal funds. It is typically required to be completed by the borrower or the recipient of the funds, ensuring compliance with laws, regulations, and policies related to the use and management of Federal funds. The form is used to document the acknowledgment and agreement to adhere to the terms and conditions of the lending agreement.

Where do I find 405 form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the el 405 certificate of nomination form in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in lic 405 form pdf without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing gujarat tax form pdf and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit gujarat tax form download on an Android device?

With the pdfFiller Android app, you can edit, sign, and share form 4056 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your 405 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lic 405 Form Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to form gujarat 1

Related to prof tax form no 1 gujarat

If you believe that this page should be taken down, please follow our DMCA take down process

here

.